Tesla Insurance safety score explained? It’s way more than just a number; it’s your digital driving report card! This score impacts your insurance premiums, reflecting how safely you actually drive your Tesla. We’ll break down what factors go into it, how your driving habits affect it, and most importantly, how to boost that score and save some serious cash on your insurance.

This deep dive explores the components of your Tesla safety score, from braking and acceleration to how well you stick to the speed limit. We’ll show you how Tesla collects this data, address privacy concerns, and compare it to other telematics programs. Ultimately, we’ll arm you with the knowledge to become a safer driver and potentially lower your insurance costs.

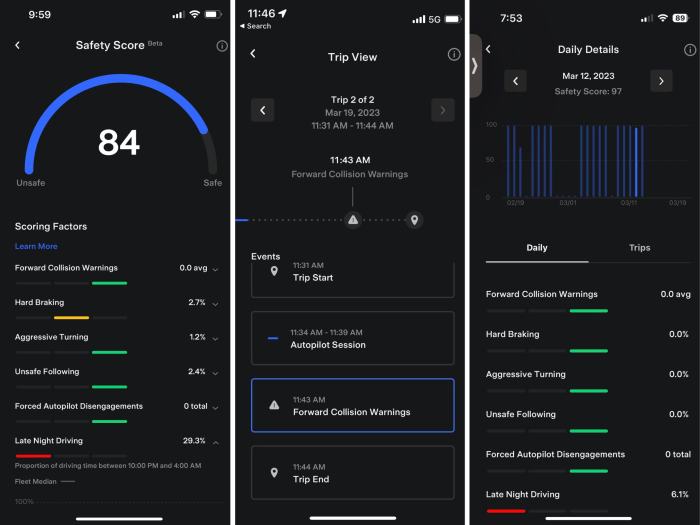

Tesla Insurance Safety Score

Tesla Insurance uses a sophisticated system to assess your driving habits and assign a safety score. This score directly impacts your insurance premium, offering lower rates for safer drivers. Understanding the components of this score can help you improve your driving and potentially save money.

Tesla Insurance Safety Score Components

The Tesla Insurance safety score is calculated using data collected from your vehicle’s sensors. Several key driving behaviors are analyzed to determine your overall score. These behaviors are not equally weighted; some have a more significant impact on your final score than others.

Weighting System and Factor Importance

While Tesla doesn’t publicly disclose the exact weighting of each factor in its proprietary algorithm, we can infer relative importance based on general driving safety principles and common sense. Generally, factors contributing to accidents, such as hard braking and aggressive cornering, will carry more weight than minor infractions. Consistent adherence to traffic laws is also a crucial component.

| Factor | Relative Importance | Description | Impact on Score |

|---|---|---|---|

| Braking | High | Frequency and intensity of hard braking events. | Frequent hard braking significantly lowers the score. |

| Acceleration | Medium | Frequency and intensity of rapid acceleration. | Excessive acceleration negatively impacts the score, though less than hard braking. |

| Cornering | High | Speed and smoothness of cornering maneuvers. | Aggressive cornering significantly lowers the score, similar to hard braking. |

| Adherence to Traffic Laws | High | Speeding, following distance, and lane changes. | Consistent adherence to traffic laws positively impacts the score; violations lower it. |

Impact of Driving Behavior on Safety Score

Your Tesla Insurance Safety Score isn’t just a random number; it’s a reflection of your driving habits. The better your driving, the lower your score (and the lower your insurance premiums!). It’s all about rewarding safe driving and incentivizing positive changes behind the wheel. This score is calculated using data collected by your car, and understanding how your actions affect it is key to saving money.The Tesla Insurance Safety Score is a dynamic system, constantly updating based on your driving data.

Several key factors heavily influence your score. Hard braking, speeding, and aggressive lane changes all contribute to a higher score, indicating riskier driving behavior. Conversely, smooth acceleration, adherence to speed limits, and predictable lane changes result in a lower score, reflecting safer driving practices. Think of it as a personalized driving report card, showing you where you excel and where you can improve.

Data Collected and Privacy Implications

Tesla collects various data points from your vehicle to calculate your Safety Score. This includes speed, acceleration, braking force, cornering, and lane positioning. The system analyzes these data points to identify patterns in your driving style. For example, frequent hard braking might indicate a tendency for following too closely or reacting poorly to unexpected situations. Similarly, excessive speeding or aggressive lane changes highlight riskier decision-making.Tesla emphasizes data privacy and assures customers that data is anonymized and aggregated before analysis.

This means individual driving habits aren’t publicly shared; the focus is on statistical analysis to improve safety and insurance risk assessment. However, it’s important to be aware of what data is collected and how it’s used. Tesla’s privacy policy provides detailed information on data collection and usage practices. While the benefits of a lower insurance premium are attractive, it’s essential to understand and be comfortable with the data collection aspects of the program.

So, you’re trying to figure out that Tesla Insurance safety score, right? It’s all about your driving habits, and how that impacts your premium. But before you dive too deep into that, you might want to check out other options like Costco car insurance reviews and cost 2025 to compare prices. Ultimately, understanding your Tesla score helps you tailor your driving and potentially save money, no matter which insurer you choose.

Examples of Positive and Negative Driving Habits

Safe driving habits translate directly into a lower Safety Score and potentially lower insurance premiums. For example, consistently maintaining a safe following distance, smoothly accelerating and decelerating, and signaling lane changes well in advance contribute to a lower score. These actions demonstrate a predictable and safe driving style.Conversely, negative driving habits lead to a higher score. This includes frequent hard braking, excessive speeding, aggressive lane changes without signaling, and tailgating.

These actions indicate riskier driving behavior and a higher likelihood of accidents. Imagine a scenario where you’re late for a meeting and aggressively weave through traffic. This type of driving will almost certainly negatively impact your score. In contrast, a calm and controlled commute, even if slightly longer, will reflect positively.

Safety Score Calculation and Updates

Tesla’s Safety Score is a dynamic rating reflecting your driving habits. It’s not just a single snapshot; it’s a constantly evolving assessment designed to incentivize safe driving and potentially lower your insurance premiums. The score considers various aspects of your driving, and understanding how it’s calculated and updated is key to maximizing your benefits.The calculation itself is proprietary, meaning Tesla doesn’t publicly reveal the exact formula.

However, we know it weighs several key factors. These include hard braking, acceleration, cornering, and adherence to speed limits. Essentially, smoother, more predictable driving leads to a higher score. Think of it like a sophisticated algorithm analyzing your driving data to quantify your risk profile. The more data Tesla collects, the more accurate and nuanced this assessment becomes.

Safety Score Update Frequency and Triggers

Tesla typically updates your Safety Score weekly. This isn’t a rigid schedule, though; significant driving events—like a hard braking incident or a near-miss—can trigger an immediate recalculation. Conversely, periods of inactivity might lead to less frequent updates. The system continuously monitors your driving behavior, aggregating data and performing updates based on the volume of data collected and the occurrence of notable driving events.

Imagine it as a constantly running background process, quietly assessing your driving performance. For example, a week with only short commutes might result in a less significant update compared to a week involving a long highway trip.

Improving Your Tesla Safety Score: A Step-by-Step Guide

Improving your Safety Score isn’t about becoming a robot behind the wheel; it’s about cultivating safer and more predictable driving habits. Here’s a practical guide to help you boost your score:

- Gentle Acceleration and Braking: Avoid sudden bursts of speed or hard braking. Smooth, gradual acceleration and deceleration are key. Think of it like driving on ice – slow and steady wins the race (and a higher safety score!).

- Maintain Safe Following Distances: Leave ample space between your vehicle and the car in front. This allows for more reaction time and prevents sudden braking. A good rule of thumb is the three-second rule: count three seconds after the car in front passes a landmark; if you reach the same landmark before you finish counting, you’re following too closely.

- Respect Speed Limits: Consistent adherence to posted speed limits is crucial. Avoid speeding, even by small increments, as this directly impacts your score. Remember, exceeding speed limits increases your risk of accidents and negatively affects your score.

- Careful Cornering: Avoid abrupt turns or excessive speeds while navigating corners. Smooth, controlled turns demonstrate better driving skills and contribute to a higher score. Imagine yourself driving a classic sports car – precision and control are paramount.

- Minimize Distractions: Focus solely on driving. Put away your phone, avoid unnecessary conversations, and ensure your attention remains on the road. Distracted driving is dangerous and detrimental to your safety score.

By consistently practicing these techniques, you can significantly improve your Tesla Safety Score over time. Remember, it’s a journey, not a race. Consistent safe driving is the key to a high score and potentially lower insurance premiums.

Safety Score and Insurance Premiums: Tesla Insurance Safety Score Explained

Your Tesla Insurance safety score directly impacts your premium. A higher score reflects safer driving habits and, consequently, lower risk for the insurance company. This translates into lower premiums for you. Conversely, a lower score indicates higher-risk driving, leading to higher premiums. The system is designed to incentivize safe driving by rewarding responsible behavior with lower insurance costs.The relationship between your safety score and your Tesla insurance premium is essentially a reflection of risk assessment.

Tesla’s algorithm analyzes various driving metrics to determine your risk profile. The better your score, the lower your perceived risk, and therefore, the lower your premium. It’s a dynamic system, meaning your score and premium can fluctuate based on your ongoing driving performance.

Hypothetical Premium Calculation

Let’s imagine three Tesla drivers with varying safety scores: Sarah has a perfect 100, John scores a 75, and David has a 50. Assume a base premium of $1000 per year for a similar Tesla model and coverage. Sarah, with her perfect score, might receive a 30% discount, resulting in a premium of $700. John, with a 75, might receive a 10% discount, leading to a premium of $900.

David, with a 50, might face a 10% surcharge, increasing his premium to $1100. These are hypothetical examples, and actual discounts or surcharges will vary depending on various factors including location, vehicle model, and coverage selected.

Safety Score and Insurance Cost Correlation

Imagine a graph with the horizontal axis representing the Tesla Safety Score (ranging from 0 to 100) and the vertical axis representing the annual insurance premium (in dollars). The line representing the relationship would show a clear negative correlation. As the safety score increases (moving from left to right on the horizontal axis), the insurance premium decreases (moving down on the vertical axis).

The line would likely be somewhat curved, with steeper decreases in premium at higher safety scores. For example, the difference between a score of 90 and 100 might result in a smaller premium reduction compared to the difference between a score of 50 and 60. This illustrates the diminishing returns of improving your score once you’re already driving very safely.

The graph visually demonstrates how responsible driving translates into significant savings on insurance costs.

Comparison with Other Telematics Programs

Tesla’s Safety Score is a unique program, but it’s not the only telematics-based insurance system out there. Many other insurance providers offer similar programs, each with its own strengths and weaknesses. Comparing these systems helps drivers understand the nuances of each and choose the program best suited to their needs and driving habits.Many competitors offer telematics programs that track driving behavior to adjust insurance premiums.

These programs often use smartphone apps or dedicated devices to monitor speed, braking, acceleration, and mileage. However, the specific metrics tracked, the weighting of those metrics, and the resulting impact on premiums vary significantly across providers. Some programs focus primarily on hard braking and speeding, while others incorporate factors like time of day and location. The level of driver feedback and transparency regarding score calculation also differs substantially.

So, you’re trying to figure out your Tesla Insurance safety score? It’s all about your driving habits, right? But did you know you could potentially save even more money by bundling your insurance? Check out this article on Discounts for bundling home and auto insurance to see how much you could save. Then, you can put those savings towards lowering your Tesla Insurance premiums, depending on your safety score of course.

Key Similarities and Differences

Most telematics programs aim to incentivize safe driving by rewarding good behavior with lower premiums. This core principle is shared across various providers, including those offered by major insurance companies like Progressive, State Farm, and Nationwide. However, the implementation differs significantly. For example, while many programs use a points-based system, the criteria for earning or losing points, and the corresponding premium adjustments, vary widely.

Some programs offer more granular feedback than others, providing detailed reports on specific driving behaviors. Tesla’s system, for example, offers a detailed breakdown of its scoring methodology, providing more transparency than some competitors. Conversely, some competitors may offer more flexibility in terms of the data collected and the ways in which it’s used to calculate premiums.

Advantages and Disadvantages of Tesla’s System, Tesla Insurance safety score explained

Tesla’s integrated system offers several advantages. Its seamless integration with the vehicle eliminates the need for separate apps or devices, simplifying the process for the driver. The detailed feedback provided helps drivers understand their driving habits and make improvements. The direct impact on insurance premiums provides a clear incentive for safe driving. However, the system is only available to Tesla owners, limiting its accessibility.

Additionally, the scoring system might penalize drivers for behaviors that are not necessarily indicative of risk, such as driving in congested urban areas. Some competitors offer more flexible programs that might be more forgiving in these situations, possibly considering external factors beyond the driver’s control. Finally, while the transparency is a positive, the complexity of the scoring algorithm may be overwhelming for some users.

Data Privacy and Security Concerns

Tesla’s Safety Score program relies on collecting and analyzing driver data, raising legitimate concerns about privacy and security. Understanding the measures Tesla implements to protect this information, as well as proactive steps drivers can take, is crucial for responsible use of the program.Tesla emphasizes the importance of data security and privacy. They state that data collected for the Safety Score is anonymized and aggregated wherever possible, limiting the personally identifiable information used.

The company uses encryption and other security protocols to protect data both in transit and at rest, aiming to prevent unauthorized access. However, like any system storing sensitive information, it’s important to be aware of potential risks and how to mitigate them.

Tesla’s Data Privacy and Security Measures

Tesla employs a multi-layered approach to data security. This includes robust encryption methods to safeguard data transmitted between vehicles and Tesla’s servers. Data stored on Tesla’s servers is also encrypted and protected by firewalls and intrusion detection systems, designed to prevent unauthorized access and cyberattacks. Regular security audits and penetration testing are conducted to identify and address vulnerabilities proactively.

Furthermore, Tesla claims adherence to relevant data privacy regulations, such as GDPR and CCPA, demonstrating a commitment to responsible data handling. The specific details of these measures, however, are not publicly available in full detail.

Driver Best Practices for Privacy Protection

While Tesla implements security measures, drivers can also take proactive steps to enhance their privacy. Regularly reviewing Tesla’s privacy policy and understanding how your data is used is a critical first step. Drivers should also be mindful of the data they share voluntarily within the app or through other connected services. For example, limiting the sharing of location data beyond what’s strictly necessary for the Safety Score calculation can improve privacy.

Maintaining strong passwords for your Tesla account and enabling two-factor authentication are additional measures to protect against unauthorized access.

Potential Risks and Mitigation Strategies

Despite Tesla’s security measures, the risk of data breaches remains a possibility. A successful breach could potentially expose sensitive driver information, such as driving habits, location data, and potentially even linked personal information. The consequences of such a breach could range from identity theft to insurance fraud. Tesla’s mitigation strategies include continuous monitoring for suspicious activity, incident response plans to address security breaches swiftly, and ongoing investment in improving security infrastructure and protocols.

While the exact details of these plans are confidential for security reasons, the commitment to data security is a key element of their stated policy.

Improving Tesla Insurance Safety Score

Boosting your Tesla Insurance Safety Score isn’t just about saving money on premiums; it’s about becoming a safer, more confident driver. A higher score reflects improved driving habits and contributes to a safer driving environment for everyone. By focusing on specific areas, you can significantly improve your score and reap the rewards.

The Tesla Insurance Safety Score is calculated based on several key driving behaviors. Understanding these factors allows you to actively work towards improvement. Consistent effort and attention to detail will yield noticeable results over time. Remember, this isn’t about perfection, but about consistent, safe driving practices.

Actionable Steps to Improve Your Safety Score

Improving your Tesla Insurance Safety Score involves a conscious effort to adopt safer driving habits. The key is consistency; small, regular improvements will add up over time to make a big difference. Focus on the areas where you need the most improvement, as highlighted in your Safety Score details.

- Maintain a Consistent Speed: Avoid excessive speeding and sudden accelerations. Smooth acceleration and deceleration are key. Think of driving as a fluid, continuous motion, not a series of bursts of speed.

- Minimize Hard Braking: Anticipate traffic conditions and maintain a safe following distance to reduce the need for sudden braking. Gentle braking is more efficient and safer.

- Avoid Aggressive Turning: Sharp turns and excessive steering inputs negatively impact your score. Smooth, controlled turns are preferred.

- Reduce Night Driving: Night driving presents increased challenges. If possible, plan your trips to avoid driving at night. If you must drive at night, ensure you are well-rested and your vehicle’s headlights are properly adjusted.

- Stay Alert and Focused: Avoid distractions such as cell phones or adjusting the infotainment system while driving. Keep your attention on the road at all times.

Benefits of a High Safety Score Beyond Lower Premiums

While lower insurance premiums are a significant benefit, a high Tesla Insurance Safety Score offers advantages beyond just financial savings. These benefits contribute to a more positive and safer driving experience.

- Increased Confidence: Knowing you’re a safer driver can boost your confidence behind the wheel, leading to a more relaxed and enjoyable driving experience.

- Improved Driving Habits: The process of improving your score encourages the development of safer, more efficient driving habits that benefit you and others on the road.

- Enhanced Peace of Mind: A high safety score provides peace of mind knowing you’re actively contributing to safer driving practices and reducing the risk of accidents.

- Potential for Future Discounts or Rewards: Tesla may introduce additional benefits or rewards for drivers with consistently high safety scores in the future.

Final Wrap-Up

So, your Tesla safety score isn’t just about lower insurance; it’s about becoming a more mindful and safer driver. By understanding the factors that contribute to your score and implementing some simple driving adjustments, you can significantly improve your rating and save money. Remember, it’s a dynamic score, so keep practicing those smooth stops and lane changes—your wallet (and your fellow drivers) will thank you!