AI-driven car insurance pricing 2025? Yeah, it’s a huge deal. Forget those old-school methods – we’re talking algorithms crunching gigabytes of data to figure out how much you should pay. Think telematics, driving habits, even where you live – it all factors in. This is shaping up to be a total game-changer for the insurance industry, but with that change comes some serious questions about fairness, privacy, and what the future holds.

This deep dive explores the tech behind AI-powered insurance pricing, the potential impact on consumers, and the ethical and legal considerations that are coming to the forefront. We’ll unpack the pros and cons, examine the role of insurers, and even take a peek into the crystal ball to see what 2025 and beyond might look like for car insurance.

Technological Advancements Driving AI in Car Insurance Pricing: AI-driven Car Insurance Pricing 2025

By 2025, AI is poised to revolutionize car insurance pricing, moving beyond traditional actuarial methods to create a more dynamic and personalized system. This shift is driven by advancements in several key AI technologies and the availability of vast amounts of new data. The result is a more accurate and efficient risk assessment process, leading to fairer and more competitive premiums for consumers.

The core of this transformation lies in the application of sophisticated AI algorithms to analyze complex datasets. This allows insurers to move beyond broad demographic categories and instead focus on individual driving behaviors and risk profiles. This results in a more nuanced and precise understanding of risk, leading to more accurate pricing.

AI Technologies in Car Insurance Pricing

AI-driven car insurance pricing in 2025 will leverage several advanced technologies. Machine learning (ML) algorithms, particularly those based on regression and classification techniques, will be central to predicting accident likelihood. Deep learning (DL), a subset of ML, will analyze more complex patterns in data, improving the accuracy of these predictions. Computer vision will play a crucial role in analyzing images from dashcams and other sources to assess driving behavior and environmental factors.

These technologies work in tandem to provide a holistic view of risk.

Improved Accuracy and Efficiency of Risk Assessment

Traditional actuarial methods rely heavily on historical data and broad demographic categories, leading to less precise risk assessments. AI, however, leverages a much wider range of data points, including real-time driving behavior from telematics devices. This allows for a more granular understanding of individual risk, leading to more accurate pricing. Furthermore, AI can automate many aspects of the risk assessment process, significantly increasing efficiency and reducing operational costs for insurance companies.

For example, AI can automatically process claims and assess the severity of damages, speeding up the claims process and improving customer satisfaction.

Data Sources for AI Car Insurance Models

The success of AI in car insurance pricing hinges on the availability of high-quality data. Several key sources fuel these models:

Telematics data, collected from devices installed in vehicles, provides real-time insights into driving behavior, including speed, acceleration, braking, and mileage. Driving behavior data, encompassing information such as accident history and traffic violations, further enhances the accuracy of risk assessment. Socioeconomic factors, such as location, credit score, and occupation, contribute to a more comprehensive profile of the insured. Combining these diverse data sources allows AI models to create highly personalized risk assessments.

Comparison of AI and Traditional Actuarial Methods

| Feature | AI-Driven Pricing | Traditional Actuarial Pricing |

|---|---|---|

| Accuracy | Higher, due to granular data analysis and real-time insights. | Lower, relying on broad demographic categories and historical data. |

| Efficiency | Greater, due to automation of many processes. | Lower, requiring significant manual effort for data analysis and risk assessment. |

| Personalization | Highly personalized, based on individual driving behavior and risk profiles. | Less personalized, relying on broad demographic categories. |

| Cost | Higher initial investment in technology and data infrastructure, but lower long-term operational costs. | Lower initial investment, but higher long-term operational costs due to manual processes. |

Impact on Consumers

AI-driven car insurance pricing promises efficiency and potentially lower premiums, but it also raises significant concerns about fairness and transparency. The shift from traditional actuarial models to AI algorithms introduces complexities that could disproportionately impact certain consumer groups, necessitating careful consideration of potential biases and the need for robust regulatory oversight. This section explores the potential effects on consumers, focusing on fairness, transparency, and the need for mitigating potential negative consequences.AI algorithms, trained on historical data, can inadvertently perpetuate existing societal biases.

For example, if the training data reflects historical discriminatory lending practices, the AI model might unfairly assess risk for certain demographics. Similarly, biases related to location (e.g., higher crime rates in certain neighborhoods) could lead to unfairly higher premiums for residents of those areas, regardless of their individual driving records. This necessitates proactive measures to ensure fairness and equity in the application of AI-driven pricing models.

Potential for Bias in AI-Driven Pricing Models and Bias Mitigation Strategies

The potential for bias in AI car insurance pricing is a serious concern. Algorithms trained on biased data will inevitably produce biased results. For instance, if the historical data used to train the algorithm shows a higher accident rate for a particular demographic group, the AI might unfairly assign higher premiums to individuals within that group, even if their individual driving behavior is exemplary.

To mitigate this, insurers need to employ rigorous data pre-processing techniques to identify and remove biases. This includes techniques like data augmentation to balance datasets and algorithmic fairness constraints to ensure equitable outcomes. Regular audits of the algorithms are crucial to detect and correct for any emerging biases. Furthermore, using diverse and representative datasets during the training process is essential to avoid reinforcing existing prejudices.

Impact of AI-Driven Pricing on Different Demographics

AI-driven pricing can differentially impact various demographic groups. Younger drivers, statistically more likely to be involved in accidents, may face higher premiums. Similarly, drivers in urban areas with higher traffic density might see increased premiums compared to those in rural areas. Conversely, older drivers with impeccable driving records might benefit from lower premiums reflecting their lower accident risk.

Location-based pricing could also disproportionately affect lower-income communities often situated in areas with higher crime rates and, consequently, higher insurance costs. These disparities necessitate careful consideration of the ethical implications and the implementation of measures to ensure equitable access to affordable insurance.

Increased Transparency in Pricing Algorithms to Build Consumer Trust

Transparency is key to building consumer trust in AI-driven pricing. Insurers should clearly explain how the AI algorithm determines premiums, highlighting the factors considered and their relative weights. This could involve providing consumers with a personalized explanation of their premium, outlining the specific factors influencing their individual rate. Providing clear and accessible information about the data used to train the algorithm and the methodology employed to mitigate bias can also foster greater trust.

Regulatory bodies can play a crucial role by mandating transparency requirements and establishing clear guidelines for AI-driven insurance pricing. This transparency fosters accountability and allows consumers to understand and challenge any perceived unfairness.

Hypothetical Scenario Illustrating Positive and Negative Impacts of AI-Driven Pricing

Consider two drivers: Maria, a 25-year-old living in a suburban area with a clean driving record, and David, a 60-year-old living in a high-crime urban area with a history of minor accidents. In a traditional system, Maria might receive a relatively high premium due to her age, while David might receive an even higher premium due to his location and accident history.

With AI-driven pricing, Maria might receive a lower premium reflecting her excellent driving record, even at a younger age, due to the AI’s ability to personalize risk assessment. Conversely, David might receive a premium that is still high, reflecting the risks associated with his location and driving history. However, the AI system could potentially identify mitigating factors, such as recent improvements in his driving behavior or safety features in his vehicle, leading to a slightly lower premium than he would have received under a traditional system.

This scenario highlights both the potential benefits of personalized pricing and the ongoing need to address potential biases.

Data Privacy and Security Concerns

The increasing reliance on AI in car insurance pricing raises significant data privacy and security concerns. Collecting and analyzing granular personal driving data, such as location, speed, and braking patterns, presents unique challenges in protecting sensitive information and ensuring responsible data usage. This section explores these challenges, the regulatory landscape, best practices, and potential legal and ethical issues.The sheer volume and sensitivity of the data collected pose a substantial risk.

A data breach could expose highly personal information, leading to identity theft, financial loss, and reputational damage for both the insurer and the policyholder. Moreover, the potential for misuse of this data is significant, including discriminatory pricing practices or the unauthorized sale of personal information to third parties.

Regulatory Landscape Surrounding AI and Personal Data in Insurance, AI-driven car insurance pricing 2025

By 2025, the regulatory landscape surrounding AI and personal data in the insurance industry is expected to be more robust and complex. Regulations like GDPR in Europe and CCPA in California already set precedents for data privacy and consumer rights. We can anticipate further legislative efforts focusing on transparency, consent, and data minimization in the use of AI for insurance pricing.

Expect to see increased scrutiny of algorithmic bias and the need for explainable AI (XAI) to ensure fairness and prevent discriminatory outcomes. For example, the insurance industry may face more stringent audits to verify compliance with data protection regulations and demonstrate the fairness of their AI-driven pricing models. These regulations will likely mandate clear communication with consumers about data collection practices, the purposes of data usage, and individuals’ rights regarding their data.

Best Practices for Data Security and Privacy in AI-Driven Car Insurance Pricing

Implementing robust data security and privacy measures is crucial. Best practices include employing strong encryption techniques to protect data both in transit and at rest, implementing strict access controls to limit who can access the data, and regularly conducting security audits and penetration testing to identify and address vulnerabilities. Data anonymization and pseudonymization techniques can also help protect individual privacy while still allowing for useful data analysis.

Furthermore, insurers should establish clear data retention policies, deleting data when it is no longer needed. Transparency is key; insurers should clearly inform consumers about the data they collect, how it’s used, and their rights under applicable data protection laws. This includes providing easily understandable privacy policies and offering consumers control over their data, such as the ability to opt out of data collection or request data deletion.

Potential Legal and Ethical Issues from Misuse of Driving Data

The misuse of driving data could lead to several legal and ethical issues. Discriminatory pricing based on protected characteristics, such as race or gender, is a major concern. Lack of transparency in algorithmic decision-making can erode consumer trust and create unfair outcomes. Unauthorized data sharing or selling of personal data to third parties violates privacy rights and could result in significant legal repercussions.

AI-driven car insurance pricing in 2025 will likely be super precise, using tons of data to personalize rates. But even with hyper-accurate predictions, understanding your deductible is key; check out the Nationwide Vanishing Deductible details for a better grasp on how that impacts your overall cost. Ultimately, knowing your deductible is just as important as the AI-generated price itself when it comes to budgeting for car insurance.

The potential for data manipulation or bias in AI algorithms could lead to inaccurate or unfair pricing, potentially causing financial harm to consumers. For instance, an algorithm trained on biased data might unfairly penalize drivers from certain demographics, leading to legal challenges and reputational damage for the insurer. Additionally, the lack of adequate oversight and accountability mechanisms for AI systems could exacerbate these problems.

Therefore, robust ethical guidelines and regulatory frameworks are necessary to mitigate these risks.

AI-driven car insurance pricing in 2025 is gonna be wild, totally changing how much we pay. If you’re thinking about snagging a sweet ride, you might want to check out the best lease deals for luxury cars in 2025, like those found on this site , before committing. Knowing your insurance costs upfront could seriously impact your decision, so factor that into your luxury car budget.

The Role of Insurers and Competition

The advent of AI-driven pricing in car insurance is fundamentally reshaping the industry landscape, forcing insurers to adapt their strategies and compete on a new playing field. This shift presents both challenges and opportunities, prompting a reevaluation of traditional business models and the development of innovative solutions. The ability to leverage AI effectively will be crucial for insurers to maintain market share and profitability in the years to come.Insurers will likely adopt diverse strategies in response to AI-driven pricing.

Some may focus on aggressively adopting AI technologies to optimize pricing models and gain a competitive edge. Others might prioritize building robust data security measures to address growing consumer concerns about privacy. A third approach could involve strategic partnerships with tech companies specializing in AI and data analytics to augment their existing capabilities. The ultimate success of each strategy will depend on factors such as the insurer’s size, resources, and risk tolerance.

Competitive Dynamics in the AI-Driven Insurance Market

The introduction of AI into car insurance pricing is expected to intensify competition and foster innovation. Companies with superior AI capabilities will be able to offer more precise and personalized pricing, potentially attracting customers who value transparency and cost-effectiveness. This could lead to a more dynamic market, with insurers constantly striving to improve their AI algorithms and data analysis techniques to maintain competitiveness.

For example, a smaller, more agile insurer might leverage AI to target niche markets or offer highly customized policies, effectively competing with larger, more established players. This contrasts with the traditional market where economies of scale often favored larger companies.

Personalized Insurance Products and Services

AI empowers insurers to move beyond simple pricing adjustments and personalize the entire customer experience. By analyzing driving behavior, lifestyle choices, and other relevant data points, insurers can tailor policies to individual needs. This could include offering discounts for safe driving habits, providing personalized safety recommendations, or bundling insurance products with other relevant services, such as roadside assistance or telematics-based driver feedback programs.

For instance, an insurer might offer a discounted rate to drivers who consistently demonstrate safe driving through the use of a connected car device, coupled with a personalized report detailing areas for improvement. This level of personalization fosters stronger customer loyalty and increases engagement.

AI-Driven Risk Management and Claims Cost Reduction

AI plays a significant role in enhancing risk management and reducing claims costs. By analyzing vast datasets, AI algorithms can identify high-risk drivers and vehicles more accurately, leading to more precise risk assessments and pricing. Furthermore, AI can streamline the claims process, reducing processing time and associated costs. For example, AI-powered image recognition can quickly assess damage to vehicles, facilitating faster claims settlements and reducing the need for costly manual inspections.

Similarly, AI algorithms can detect fraudulent claims by identifying patterns and inconsistencies in claims data, minimizing financial losses for insurers. This improved efficiency translates directly into lower operational costs and potentially lower premiums for consumers.

Future Trends and Predictions for 2025 and Beyond

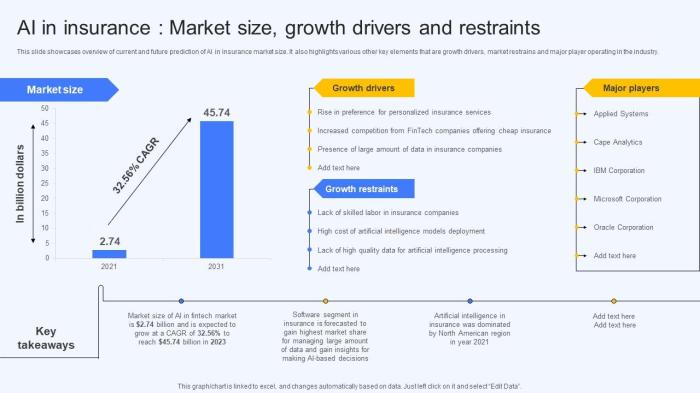

Predicting the future of AI in car insurance is like trying to guess the next big tech startup – exciting, uncertain, and potentially wildly profitable. By 2025, we’ll likely see a significant shift towards AI-driven pricing, but complete dominance is unlikely. Several factors, including consumer trust and regulatory hurdles, will influence the adoption rate.AI’s impact on car insurance pricing will continue to evolve rapidly.

The speed of this evolution depends on factors such as technological breakthroughs, consumer acceptance, and the regulatory landscape. We can expect ongoing refinement of existing AI models, leading to more accurate and personalized pricing.

AI Adoption Rate in Car Insurance by 2025

Many insurers are already experimenting with AI-driven pricing models. However, widespread adoption by 2025 will depend on several factors. A realistic prediction is that a significant portion (perhaps 30-40%) of major insurers will integrate AI into their pricing algorithms for a substantial portion of their customer base. This figure is based on current adoption rates and the projected pace of technological development and regulatory changes.

Smaller, more agile insurers might lead the way, while larger companies might adopt a more cautious, phased approach. We might see regional variations, with more technologically advanced markets showing higher adoption rates.

Future Developments in AI Technology Transforming Car Insurance Pricing

Several technological advancements will further refine AI’s role in car insurance pricing. Advancements in machine learning, specifically deep learning and reinforcement learning, will enable insurers to create even more sophisticated risk assessment models. The incorporation of alternative data sources, such as telematics data from connected cars and wearable technology, will provide a richer picture of driving behavior. Explainable AI (XAI) will become increasingly important, allowing insurers to better understand and communicate the rationale behind AI-generated premiums to customers, fostering transparency and trust.

Finally, the integration of blockchain technology could enhance data security and improve the efficiency of claims processing.

Impact of Autonomous Vehicles on AI-Driven Car Insurance Pricing

The rise of autonomous vehicles will fundamentally alter the car insurance landscape. AI will play a critical role in assessing the risk associated with self-driving cars. Insurers will need to develop new pricing models that account for the unique safety features and operational characteristics of autonomous vehicles. For example, premiums might be based on the level of autonomy (e.g., fully autonomous vs.

partially autonomous), the manufacturer’s safety record, and the vehicle’s performance data collected through its sensors. We might even see a shift towards usage-based insurance, where premiums are determined by the distance driven or the number of trips taken. The potential for dramatically reduced accident rates could lead to significantly lower premiums for autonomous vehicle owners.

Timeline of AI-Driven Car Insurance Pricing Development and Implementation

A simplified timeline illustrating key milestones might look like this:

| Year | Milestone |

|---|---|

| 2018-2020 | Early adoption of AI in specific aspects of insurance pricing (e.g., fraud detection). Increased experimentation with telematics data. |

| 2021-2023 | Increased investment in AI-driven pricing models. Development of more sophisticated algorithms. Regulatory discussions begin concerning data privacy and algorithmic bias. |

| 2024-2025 | Significant uptake of AI-driven pricing by major insurers. Focus on explainability and transparency. Increased use of alternative data sources. |

| 2026-2030 | Widespread adoption of AI-driven pricing. Integration with autonomous vehicle technology. Development of new insurance products tailored to autonomous vehicles. |

Concluding Remarks

So, AI-driven car insurance in 2025? It’s definitely going to be a wild ride. While it promises more accurate and potentially cheaper premiums for some, it also brings up important questions about bias, privacy, and the overall fairness of the system. The insurance industry is on the cusp of a massive transformation, and how it handles these challenges will determine whether this technology benefits everyone or just a select few.

Buckle up, because the future of car insurance is here.