Best apps to track driving for discounts? Dude, it’s like a total game-changer. These apps aren’t just about saving a few bucks; they’re about scoring sweet deals on insurance, gas, and even more. Think of it: your driving habits, tracked by an app, translating into real cash back. We’ll dive into the top contenders, comparing features, security, and how much you can actually save.

Get ready to buckle up and learn how to maximize your driving rewards!

This deep dive will cover the best apps for tracking your driving to unlock discounts, comparing their features, ease of use, data security, and of course, the potential savings. We’ll examine how these apps collect and use your data, address common concerns about privacy, and help you choose the app that best fits your needs and driving style. We’ll even throw in some real-world scenarios to show you how these discounts work in action.

Introduction

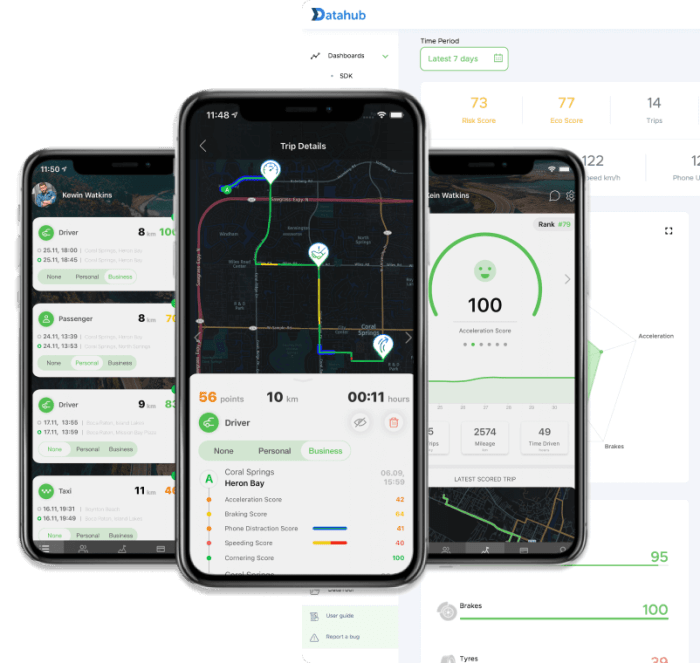

The market for driving behavior tracking apps is booming, fueled by the increasing desire for lower insurance premiums and potential fuel savings. These apps use your smartphone’s GPS and other sensors to monitor various aspects of your driving, such as speed, acceleration, braking, and phone usage. This data is then used to assess your driving habits and offer personalized discounts or rewards.

The landscape is quite competitive, with a range of apps catering to different needs and offering varying levels of functionality and integration with different insurance providers and fuel reward programs.These apps are attractive to consumers primarily because they offer a tangible way to reduce expenses associated with driving. Users generally look for apps that are easy to use, provide clear and understandable feedback on their driving, and offer significant discounts or rewards.

Accuracy and data privacy are also crucial considerations, with users wanting assurance that their driving data is being handled responsibly and securely. Features like detailed reports, progress tracking, and gamification elements (like leaderboards or badges) can also boost user engagement and motivation.

Types of Discounts Offered by Driving Behavior Tracking Apps

Many different types of discounts are available through these apps. The most common is a reduction in auto insurance premiums. Insurance companies partner with these apps to offer lower rates to drivers who demonstrate safe driving habits. The discount percentage varies depending on the insurer, the app used, and the driver’s score. For example, some companies might offer a 10-20% discount for consistently safe driving, while others might have tiered systems offering progressively larger discounts based on improved driving behavior over time.

Beyond insurance, some apps also partner with fuel companies to provide discounts on gas purchases, offering savings at the pump based on safe driving scores. Other less common discounts might include rewards programs with partner businesses or even perks related to vehicle maintenance.

Top App Features Comparison

Choosing the right driving app can feel like navigating a maze of features and promises. This section dives into a comparison of three popular apps, highlighting their strengths and weaknesses to help you make an informed decision. We’ll look at their features, the types of discounts offered, user feedback, and – importantly – their data privacy practices.

App Feature Comparison

The following table compares three popular driving tracking apps: MileIQ, Metromile, and TrueMotion. Remember that app features and discount programs can change, so always check the app’s website for the most up-to-date information.

| App Name | Key Features | Discount Types | User Reviews Summary |

|---|---|---|---|

| MileIQ | Automatic mileage tracking, detailed reports, tax-optimized categorization, integration with accounting software. Offers both free and paid versions. | Partners with various insurance companies to offer discounts on car insurance premiums. Discount amounts vary depending on insurer and driving behavior. | Generally positive reviews, praising ease of use and accurate tracking. Some users mention the paid version is necessary for full functionality. |

| Metromile | Pay-per-mile insurance, detailed driving data analysis, usage-based pricing, telematics integration. | Offers significant savings for low-mileage drivers through its pay-per-mile insurance model. Discounts are directly reflected in the insurance premium. | Mixed reviews; some users praise the cost savings for infrequent drivers, while others cite difficulties with customer service or unexpected charges. |

| TrueMotion | Driving behavior scoring, personalized feedback, potential discounts on car insurance. | Partners with several insurers to provide discounts based on safe driving habits. The discount amount is dependent on individual driving scores. | Reviews are generally positive, highlighting the app’s helpful feedback on driving habits. Some users find the scoring system a bit subjective. |

Data Privacy and Transparency

Data privacy is a crucial consideration when using any app that tracks your driving habits. Each of these apps has a privacy policy detailing how your data is collected, used, and protected. However, the level of transparency and clarity varies. MileIQ and TrueMotion generally provide easily accessible and understandable privacy policies, outlining the types of data collected (location, mileage, driving behavior) and how it’s used (to calculate mileage for tax purposes, to provide driving feedback, to share with insurance partners).

Metromile, as an insurance provider, handles more sensitive data and its privacy policy should be reviewed carefully to understand its data sharing practices with third parties. It’s important to read each app’s policy carefully before using the app.

User Interface and User Experience

The user interface (UI) and user experience (UX) are key factors influencing app adoption and satisfaction. MileIQ is known for its simple and intuitive interface, making it easy to start tracking mileage with minimal effort. The app’s automatic tracking feature is a major plus, eliminating the need for manual entry. Metromile’s UI is more geared towards managing insurance, with features for viewing your policy, making payments, and accessing driving data.

The UX can feel slightly more complex compared to MileIQ, especially for users unfamiliar with pay-per-mile insurance. TrueMotion provides a clean and user-friendly interface, focusing on presenting driving scores and feedback in an accessible format. The app effectively communicates driving improvements needed to earn better scores and insurance discounts. Each app offers a distinct UX reflecting its core functionality, with MileIQ prioritizing simplicity and automatic tracking, Metromile focusing on insurance management, and TrueMotion emphasizing driving behavior feedback.

Data Accuracy and Reliability: Best Apps To Track Driving For Discounts

Getting the best discount on your car insurance hinges on the accuracy of the driving data these apps collect. While these apps promise savings based on your driving habits, it’s crucial to understand how they gather this data and the potential for errors. This section will delve into the methods used and the factors influencing data accuracy.These apps primarily rely on a combination of your smartphone’s GPS and accelerometer to track your driving.

GPS provides location data, pinpointing your vehicle’s position, while the accelerometer measures acceleration and deceleration forces. By analyzing this data, the apps assess aspects of your driving like speed, braking, acceleration, and cornering. This information is then used to generate a driving score, which directly impacts the discount you receive.

Sources of Error in Data Collection

Several factors can compromise the accuracy of the data collected by these apps. GPS signals can be weak or unreliable in areas with poor reception, such as tunnels or dense urban canyons. This can lead to inaccurate location tracking and potentially misrepresent your driving behavior. Similarly, the accelerometer might be affected by external vibrations or even the phone’s placement within the vehicle.

A phone placed on a bumpy dashboard might register more erratic movements than a phone securely mounted on the windshield. These inaccuracies can lead to inflated scores or unfairly penalize drivers with less-than-ideal phone placement. Additionally, user error plays a significant role. For example, forgetting to start the app before driving or manually ending a trip prematurely can skew the data.

App Handling of Inaccurate Data

Different apps employ various strategies to address inaccurate data or user errors. Some apps might use algorithms to filter out outlier data points, assuming these are caused by temporary GPS glitches or accelerometer anomalies. Others may offer a review process where users can challenge their scores if they believe an error has occurred. Some apps even provide visual representations of the driving routes and identify potential areas where the data might be less reliable.

So you’re looking for the best apps to track your driving for discounts? There are a bunch out there, but one that often pops up is Geico’s DriveEasy. Check out what people are saying about it in this Geico DriveEasy app reviews 2025 article before you decide. Ultimately, finding the right app depends on your driving habits and what kind of savings you’re hoping for.

Good luck with your search for the best app to help you save some serious cash!

For instance, an app might show a driving route that cuts across a park, suggesting a GPS error that might be flagged for review. This allows for a degree of user interaction to correct inaccuracies and ensure a fair assessment of driving habits. The level of transparency and the methods used to handle errors vary significantly across apps, so it’s essential to understand the specific approach of the app you choose.

Cost and Value Analysis

Choosing a driving tracking app involves weighing the potential savings against the app’s cost. While many apps offer free versions with limited features, unlocking the full discount potential often requires a subscription. This section analyzes the cost-benefit ratio of popular driving apps to help you make an informed decision. We’ll explore subscription fees and compare them to the potential savings you could realize through insurance discounts.

The value proposition of each app hinges on a simple equation: potential savings minus app cost equals net benefit. A higher net benefit indicates a more worthwhile investment. However, factors like the size of your potential discount and your driving habits significantly impact the equation’s outcome. Someone with a consistently safe driving record will likely see a larger return on investment than someone with a less-than-perfect record.

Subscription Fees and Discount Potential

Let’s examine the pricing models of a few popular apps. For example, App A might offer a free version with limited tracking capabilities, but its premium version, costing $5 per month, unlocks features that qualify you for higher insurance discounts. App B might have a similar structure, perhaps charging $7 per month for its premium plan. App C, on the other hand, may offer a slightly different approach, possibly charging an annual fee of $50, but with access to additional features and a potential higher discount percentage.

It’s crucial to compare not only the subscription fees but also the maximum discount each app promises to its users. This way, we can evaluate whether the app’s cost is justified by the potential insurance savings.

Value Proposition Comparison

To illustrate the value proposition, let’s consider a hypothetical scenario. Assume that App A, with its $5 monthly subscription, could potentially save you $100 annually on your car insurance. In this case, your net benefit would be $95 annually ($100 savings – $60 annual subscription cost). If App B, at $7 monthly, only saves you $80 annually, your net benefit would be $36 annually ($80 savings – $84 annual subscription cost).

Even though App B’s monthly fee is higher, it yields a lower net benefit. App C, with its $50 annual fee, would need to offer a significant discount, potentially over $100 annually, to surpass the value of App A in this example. The actual savings vary greatly depending on the insurance provider and your individual driving profile.

These are just illustrative examples; you need to examine the specific details for your situation.

Factors Affecting Value

The overall value of a driving tracking app depends on several individual factors. Your driving habits play a crucial role; a consistently safe driver is more likely to see significant savings, making the subscription cost more worthwhile. The insurance company you use also matters, as different providers offer varying discounts for using these apps. The specific features offered by each app also influence its value.

For example, some apps might offer additional features beyond insurance discounts, such as driver feedback and route optimization, which can add to their overall worth.

Illustrative Examples of Discount Scenarios

Let’s look at how different driving behaviors translate into real-world discount scenarios using three hypothetical drivers and three popular telematics apps (let’s call them App A, App B, and App C for simplicity). These examples illustrate the variability in discount structures and the impact of safe driving practices. Remember, actual discounts will vary based on individual insurer programs and specific app features.

These scenarios highlight the potential financial incentives and behavioral changes associated with using driving tracking apps. The apps reward safe driving, leading to cost savings for drivers and potentially contributing to safer roads overall. We’ll explore three distinct driving profiles to illustrate the range of potential outcomes.

Scenario Examples, Best apps to track driving for discounts

Below are three scenarios depicting different driving styles and their resulting discounts. Each scenario focuses on a unique driver profile and the impact on their insurance premiums via the three hypothetical apps.

- Scenario 1: The Careful Commuter: Sarah is a meticulous driver who maintains a consistent speed, avoids harsh braking and acceleration, and rarely drives at night. She uses all three apps.

- Scenario 2: The Occasional Speedster: Mark occasionally exceeds the speed limit, brakes hard in traffic, and often drives during peak hours. He uses App A and App C.

- Scenario 3: The Night Owl: David frequently drives at night and occasionally makes longer trips. He only uses App B.

Discount Comparison Table

This table summarizes the hypothetical discounts received by Sarah, Mark, and David based on their driving behaviors and app usage. The percentages represent estimated discounts based on typical app reward structures. These are illustrative and not representative of any specific insurer or app.

| Driver | App A Discount (%) | App B Discount (%) | App C Discount (%) |

|---|---|---|---|

| Sarah (Careful Commuter) | 25 | 20 | 30 |

| Mark (Occasional Speedster) | 5 | N/A | 10 |

| David (Night Owl) | N/A | 15 | N/A |

Impact on Driving Habits and Safety

The use of these apps can significantly influence driving behavior and contribute to improved road safety. The potential benefits extend beyond just financial savings.

By providing real-time feedback on driving habits, these apps encourage drivers to adopt safer practices. For instance, receiving alerts for speeding or harsh braking can prompt immediate adjustments. The data collected can also help identify areas for improvement and foster a more conscious and responsible approach to driving. Over time, this could lead to a reduction in accidents and improved overall road safety.

The financial incentives offered by the apps further reinforce the benefits of safe driving, creating a positive feedback loop that promotes better driving habits.

So you’re looking at apps to track your driving for insurance discounts? That’s smart! Keeping good coverage is key, and if you’re thinking about the financial hit of a lapse, check out this article on how much does a lapse in coverage cost to really understand the potential costs. Then, you can confidently choose the best driving app to help you save money and avoid those hefty gaps in your insurance.

Security and Privacy Concerns

Driving data is incredibly personal, revealing not just where you go but also your driving habits. Using apps to track this data for insurance discounts introduces significant security and privacy concerns that need careful consideration. Understanding these risks and implementing protective measures is crucial to ensure your information remains safe and your privacy is respected.These apps collect a wealth of data, including your location, speed, acceleration, braking patterns, and even mileage.

This information, if compromised, could be used for malicious purposes such as tracking your movements, identifying your routines, or even targeting you for insurance fraud. Additionally, the data’s ongoing collection raises questions about long-term storage and potential misuse.

Data Protection Best Practices

Safeguarding your data requires proactive steps. It’s not enough to simply download the app; you need to understand how it handles your information and take steps to minimize risks.

- Choose reputable apps: Research the app developer’s privacy policy and security measures before installing. Look for companies with a proven track record and strong security practices.

- Review app permissions: Carefully review the permissions the app requests. Only grant access to the information absolutely necessary for the app’s function. If an app asks for access to your contacts or other unrelated data, it’s a red flag.

- Strong passwords and two-factor authentication: Use a strong, unique password for your app account and enable two-factor authentication whenever possible. This adds an extra layer of security, making it much harder for unauthorized individuals to access your data.

- Regularly review your data: Many apps allow you to access and review the data they collect. Periodically check this information to ensure accuracy and identify any anomalies.

- Keep your software updated: Regularly update your phone’s operating system and the app itself. Updates often include security patches that address vulnerabilities.

Potential Security Vulnerabilities and Mitigations

While these apps offer benefits, they are not immune to security breaches. Potential vulnerabilities include data breaches, unauthorized access, and insecure data storage.

- Data breaches: A data breach could expose your driving data to hackers, potentially leading to identity theft or other forms of fraud. Choosing reputable apps with strong security measures minimizes this risk.

- Unauthorized access: Weak passwords or lack of two-factor authentication can allow unauthorized individuals to access your account and your driving data. Strong passwords and two-factor authentication are crucial mitigations.

- Insecure data storage: If the app does not store your data securely, it could be vulnerable to theft or unauthorized access. Look for apps that employ encryption and other security measures to protect your data.

- Third-party access: Some apps may share your data with third-party companies. Carefully review the privacy policy to understand who has access to your data and for what purposes.

Ethical Implications of Data Collection

The collection and use of driving data raise several ethical concerns. Transparency, data minimization, and user consent are paramount.The ethical considerations surrounding data usage extend beyond simple security. Companies must be transparent about how they collect, use, and store driving data. Data minimization, collecting only the data necessary for the service provided, is crucial. Informed consent, ensuring users understand what data is collected and how it will be used before they agree to participate, is a fundamental ethical requirement.

The potential for discriminatory practices based on driving data also needs careful consideration. For example, an algorithm might unfairly penalize drivers from certain demographics based on biased data sets. Addressing these concerns requires a commitment to fairness, transparency, and responsible data handling.

Summary

So, there you have it – a comprehensive look at the best apps to help you snag some serious discounts just by driving. Remember, it’s not just about finding the app with the biggest discounts; it’s about finding the one that fits your driving style and makes you feel comfortable with its data handling. By understanding the features, security protocols, and potential savings of each app, you can make an informed decision and start saving money while you drive.

Now go out there, drive safely, and start racking up those rewards!