Blockchain for auto insurance claims? Yeah, it sounds kinda geeky, but hear me out. Imagine a system where your accident claim is processed faster, more securely, and with way less paperwork. That’s the promise of blockchain, using its super-secure, transparent ledger to revolutionize how we handle insurance. This isn’t just about speeding things up; it’s about building a more trustworthy and efficient system for everyone involved.

We’ll dive into the tech behind it – think immutable records and smart contracts – and explore how it tackles issues like fraud and data sharing. We’ll even look at real-world examples and what the future might hold for this game-changing technology in the insurance world. Get ready to ditch the endless phone calls and paperwork!

Blockchain Technology Fundamentals in Insurance

Blockchain technology is revolutionizing various industries, and insurance is no exception. Its core principles of immutability and transparency offer significant advantages in streamlining and securing the claims process, particularly in auto insurance. This section will explore how blockchain’s fundamental concepts translate into practical improvements for insurance companies and policyholders.

Immutability and Transparency in Blockchain

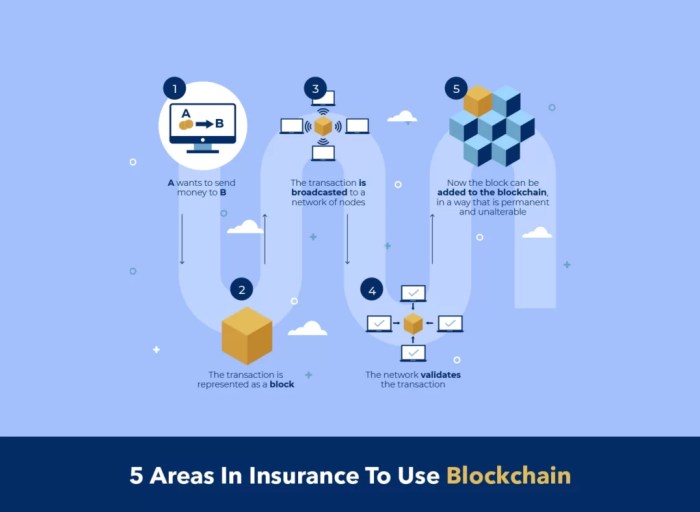

Blockchain’s power lies in its decentralized and immutable ledger. Each transaction, or “block,” is cryptographically linked to the previous one, creating a chronologically ordered and tamper-proof chain. This immutability ensures that once a claim is recorded on the blockchain, it cannot be altered or deleted without detection. Transparency, another key feature, allows all authorized participants to view the entire transaction history, promoting accountability and trust.

In the context of auto insurance, this means all parties – the insurer, the insured, and even repair shops – can access the same verifiable record of the claim, reducing disputes and speeding up the process.

Blockchain’s Application to Auto Insurance Claims

Imagine a scenario where an accident is reported. Using blockchain, the accident details, photos, repair estimates, and payment records are immediately and securely recorded on the shared ledger. Every step of the claims process, from initial report to final settlement, is transparently documented. This eliminates the potential for fraud or manipulation, as any attempt to alter information would be immediately flagged.

The blockchain’s distributed nature also enhances resilience, meaning the system isn’t vulnerable to single points of failure, unlike centralized databases.

Enhanced Data Security in Auto Insurance Claims

Blockchain enhances data security in several ways. First, the cryptographic hashing mechanism ensures the integrity of each block, preventing unauthorized modifications. Second, the decentralized nature of the blockchain eliminates the risk of data breaches from a single point of attack. Third, smart contracts, self-executing contracts with the terms of the agreement written directly into code, can automate certain aspects of the claims process, reducing the risk of human error and fraud.

For example, a smart contract could automatically release payment to a repair shop once the repair work is verified and approved.

Comparison of Traditional and Blockchain-Based Claim Processing

| Feature | Traditional Insurance Claim Processing | Blockchain-Based Insurance Claim Processing |

|---|---|---|

| Speed | Often slow, involving multiple intermediaries and paperwork. Weeks or even months for settlement. | Significantly faster due to automation and transparency. Days or even hours for settlement in some cases. |

| Cost | Higher due to administrative overhead, paperwork, and potential disputes. | Lower due to automation, reduced paperwork, and fewer disputes. |

| Security | Vulnerable to fraud, data breaches, and manipulation. | Highly secure due to immutability and cryptographic hashing. Reduced risk of fraud and data breaches. |

| Transparency | Limited transparency, with information siloed among different parties. | High transparency, with all authorized parties having access to the same verifiable record. |

Smart Contracts and Automation in Auto Insurance Claims

Smart contracts offer a revolutionary approach to auto insurance claims processing, leveraging blockchain’s transparency and immutability to streamline the entire process. By automating various stages, from initial claim submission to final settlement, smart contracts promise faster payouts, reduced costs, and increased efficiency for both insurers and policyholders. This section delves into the specifics of how smart contracts achieve this transformation.Smart contracts, essentially self-executing contracts with the terms of the agreement directly written into code, play a pivotal role in automating claims processing.

They eliminate the need for intermediaries, reducing delays and costs associated with manual verification and paperwork. This automation drastically improves the overall efficiency and transparency of the claims process.

Smart Contract Design for Auto Insurance Claims

A hypothetical smart contract for an auto insurance claim would incorporate several key functionalities. Upon triggering the contract (e.g., a policyholder submitting a claim via a mobile app), the smart contract would first verify the policy’s validity and coverage. This involves checking the policyholder’s identity, the date of the accident, and whether the damage falls under the policy’s covered perils.

If verified, the contract would then facilitate the submission of supporting documentation, such as photos of the damaged vehicle and a police report. These documents would be stored securely and immutably on the blockchain. Next, the smart contract would initiate an automated assessment of the claim, potentially using AI-powered image recognition to determine the extent of the damage.

Based on pre-defined rules and algorithms encoded within the contract, the claim amount would be calculated automatically. Finally, upon confirmation of the assessment, the smart contract would automatically transfer the approved settlement amount to the policyholder’s designated account.

Reduced Processing Time and Human Intervention, Blockchain for auto insurance claims

The automation enabled by smart contracts significantly reduces processing time compared to traditional methods. Instead of weeks or even months for claim processing, smart contracts can potentially settle claims within days or even hours. This speed is achieved by eliminating the need for manual data entry, verification, and approval from multiple human agents. The process becomes significantly more efficient, reducing the operational overhead for insurance companies.

The reduction in human intervention also minimizes the potential for errors and biases, leading to more accurate and fair claim settlements. For example, a traditional claim might take an average of 30 days to process, whereas a smart contract-based system could potentially reduce this to just 3 days.

Challenges in Implementing Smart Contracts for Auto Insurance

Despite the potential benefits, several challenges need to be addressed for successful implementation. One major hurdle is the need for a robust and secure blockchain infrastructure capable of handling the large volume of transactions involved in auto insurance claims. Another challenge lies in the complexity of developing and deploying smart contracts that accurately reflect the nuances of insurance policies and regulations.

Ensuring the security and immutability of the smart contract code is crucial to prevent fraud and manipulation. Additionally, integrating smart contracts with existing insurance systems and legacy databases can be a significant technological undertaking. Finally, legal and regulatory frameworks surrounding the use of smart contracts in insurance need further development to ensure compliance and address potential legal disputes.

Data Integrity and Fraud Prevention: Blockchain For Auto Insurance Claims

Blockchain technology offers a compelling solution to the long-standing problem of data integrity and fraud in auto insurance claims. Its decentralized and immutable nature provides a robust system for recording and verifying claim information, reducing the potential for manipulation and improving transparency throughout the claims process. This leads to faster claim settlements, lower costs, and increased trust between insurers and policyholders.Blockchain enhances data integrity by creating a shared, tamper-proof ledger.

Every transaction, from the initial accident report to the final payment, is recorded as a block and linked cryptographically to the previous block. This chronological chain of records makes it extremely difficult to alter or delete information without detection. Furthermore, the distributed nature of the blockchain means that data isn’t stored in a single location, making it resilient to data loss or corruption.

This increased transparency also allows for easier audits and regulatory compliance.

Blockchain’s Role in Preventing Fraudulent Claims

The immutability of the blockchain makes it significantly harder to submit fraudulent claims. For example, a claim involving a staged accident would be difficult to fabricate because all relevant data, including repair estimates, medical reports, and police reports, would be recorded on the blockchain and accessible to all participants. Any attempt to alter this information would be immediately flagged.

Furthermore, smart contracts can automate the verification process, comparing data from various sources to identify inconsistencies that might indicate fraud. This automated verification system reduces the reliance on manual processes, which are prone to human error and potential bias.

Potential Vulnerabilities and Mitigation Strategies

While blockchain offers significant advantages, it’s crucial to acknowledge potential vulnerabilities. One concern is the potential for 51% attacks, where a malicious actor controls a majority of the network’s computing power to manipulate the blockchain. However, this is unlikely in a well-designed, widely distributed blockchain network. Another vulnerability is the security of the smart contracts themselves. Bugs or vulnerabilities in the code could be exploited by malicious actors.

Mitigation strategies include rigorous code audits, penetration testing, and the use of multiple layers of security. Furthermore, ensuring proper access control and data encryption is critical to protect sensitive information stored on the blockchain.

Comparison of Blockchain-Based and Traditional Fraud Detection Methods

Let’s compare the effectiveness of blockchain-based fraud detection with traditional methods.

It’s important to note that a purely blockchain-based system is likely unrealistic in the near future. A hybrid approach, integrating blockchain with traditional systems, offers the most practical solution.

- Traditional Fraud Detection:

- Advantages: Established infrastructure, readily available expertise.

- Disadvantages: Prone to human error, susceptible to manipulation, slow and costly investigations, data silos hinder comprehensive analysis.

- Blockchain-Based Fraud Detection:

- Advantages: Enhanced data integrity, increased transparency, automated verification, faster claim processing, reduced costs associated with investigations and disputes.

- Disadvantages: Relatively new technology, requires specialized expertise, potential scalability challenges, implementation costs, vulnerability to smart contract exploits (mitigated by robust security measures).

Interoperability and Data Sharing

Sharing data between different insurance companies is a huge hurdle in the auto insurance world. Right now, it’s a fragmented mess, with each company using its own systems and formats. But a blockchain-based system offers the potential to dramatically change this by creating a secure and standardized way to share information. This leads to quicker claims processing, reduced fraud, and a much smoother experience for everyone involved.Blockchain’s decentralized nature allows for secure data sharing without the need for a central authority acting as a middleman.

This transparency and trust build efficiency and reduces the risk of data manipulation. However, achieving this seamless data exchange requires careful consideration of several key factors, including the establishment of common standards and protocols.

Challenges and Opportunities in Cross-Company Data Sharing

The transition to a blockchain-based system for inter-company data sharing presents both significant challenges and exciting opportunities. One major challenge lies in achieving consensus among different insurance companies on data standards and formats. Each company might have its own legacy systems and data structures, making integration complex. Another challenge is the regulatory landscape; ensuring compliance with data privacy regulations like GDPR and CCPA is crucial.

However, the potential rewards are substantial. Imagine a system where claims are processed almost instantly, fraud is significantly reduced, and customers have a more streamlined experience. This would lead to lower operational costs for insurance companies and increased customer satisfaction. The opportunity lies in building a more efficient and transparent ecosystem.

Potential Standards and Protocols for Interoperability

Several standards and protocols could facilitate interoperability in a blockchain-based auto insurance ecosystem. For instance, using standardized data formats like HL7 FHIR (Fast Healthcare Interoperability Resources) adapted for insurance data could ensure seamless data exchange between different systems. Furthermore, implementing well-defined APIs (Application Programming Interfaces) would allow different blockchain networks to communicate with each other, promoting interoperability. Establishing industry-wide governance bodies could help define and enforce these standards, ensuring consistency across the ecosystem.

Open-source blockchain platforms could further enhance interoperability by enabling the creation of modular and customizable solutions.

Stakeholders Involved in Data Sharing

The success of a blockchain-based data sharing system hinges on the collaboration of various stakeholders. A smooth and efficient system requires clear communication and a shared vision among all participants.

- Insurance Companies: They are the primary users of the system, needing to share and receive data securely and efficiently.

- Insureds/Policyholders: They benefit from faster claims processing and increased transparency.

- Repair Shops: Direct data exchange with insurance companies can streamline the repair process.

- Claims Adjusters: Access to a shared and verifiable database can significantly expedite their work.

- Government Regulatory Bodies: They play a vital role in ensuring compliance with data privacy and security regulations.

- Technology Providers: They develop and maintain the blockchain infrastructure and related applications.

Benefits of Secure Data Sharing for Claims Processing Efficiency

Secure data sharing through blockchain technology offers several key benefits for improving the efficiency of the auto insurance claims process. For example, real-time data access enables faster claim verification and reduces processing times. The immutability of blockchain ensures data integrity, minimizing disputes and accelerating settlements. Automated workflows, triggered by smart contracts, further streamline the process, reducing manual intervention and potential errors.

This increased efficiency translates to cost savings for insurance companies and a significantly improved experience for policyholders. Consider a scenario where a claim is submitted, and all relevant data (accident report, vehicle damage assessment, etc.) is instantly available to the insurer on the blockchain. This eliminates delays caused by manual data gathering and verification, resulting in faster payouts and greater customer satisfaction.

Real-world Applications and Case Studies

While the potential of blockchain in auto insurance is huge, real-world implementations are still emerging. However, several companies are pioneering its use, demonstrating tangible benefits in efficiency and security. These early adopters provide valuable case studies illustrating the technology’s practical application and highlighting areas for further development.Several companies are exploring blockchain’s potential to streamline auto insurance claims.

These applications range from improving data security and reducing fraud to accelerating claim processing times and enhancing transparency. The following sections delve into specific examples and compare different approaches.

Examples of Real-world Blockchain Applications in Auto Insurance

Several companies are actively exploring blockchain’s potential in auto insurance claims. For example, some insurers are using blockchain to create a secure, immutable record of vehicle maintenance and repair history. This enhances transparency and reduces disputes over pre-existing damage. Other initiatives focus on using blockchain to securely share data between insurers and repair shops, speeding up the claims process.

Blockchain tech could totally revolutionize auto insurance claims processing, making things faster and more transparent. Think about how much that could impact your monthly premiums – check out this projection for the average car insurance cost per month in Texas in 2025 to see what I mean. Ultimately, blockchain’s potential to streamline claims could lead to lower costs for everyone.

Finally, some companies are exploring the use of blockchain to verify the authenticity of parts used in repairs, preventing the use of counterfeit components.

Case Study: A Hypothetical Blockchain-Based Claims System

Imagine a scenario where a driver, Alice, is involved in a minor fender bender. Using a blockchain-based system, her smartphone automatically records the accident details, including photos and location data, and securely timestamps the information on the blockchain. This data is immediately shared with Alice’s insurer, Bob’s Insurance, and the other driver’s insurer, Carol’s Insurance. Both insurers can verify the information independently, eliminating disputes about the accident details.

Alice’s repair shop uploads the repair invoice and photos to the blockchain. Bob’s Insurance verifies the invoice and the parts used, confirming their authenticity through a blockchain-based parts tracking system. The claim is processed and settled significantly faster than with traditional methods, due to the transparency and immutability of the blockchain record. This streamlined process reduces costs for both insurers and provides a better experience for Alice.

Blockchain tech could totally revolutionize auto insurance claims by creating a transparent, tamper-proof record of everything. But, let’s say you’re dealing with a claim right now – you’ll probably want to check out the process first, like How to file a claim with USAA , to get things moving. Then, imagine how much smoother claims would be with the added security and efficiency of blockchain in the future.

Comparison of Blockchain Platforms in Insurance

Different blockchain platforms offer varying features and functionalities, making the choice of platform crucial for successful implementation. Hyperledger Fabric, a permissioned blockchain, is popular due to its flexibility and control over network participants, making it suitable for collaborations between insurers and other stakeholders. Ethereum, a public blockchain, offers smart contract functionality but might be less suitable for sensitive insurance data due to its public nature.

The selection depends on the specific needs and priorities of the insurer, including the level of transparency desired and the need for specific features such as smart contracts.

Visual Representation of a Blockchain-Based Auto Insurance Claim

Imagine a flowchart. The process begins with the accident, where data (location, photos, witness statements) is recorded on a smartphone. This data is then hashed and added as a block to the blockchain. A second block contains the claim submission details from the insured. Subsequent blocks include verification steps: insurer verification of the accident details, repair shop verification of the repair work and parts used, and finally, payment confirmation.

Each block links to the previous one, creating a chronologically ordered, immutable chain of events. All parties involved (insured, insurer, repair shop) have access to this shared, transparent record. The entire process is streamlined, with each step recorded and verifiable on the blockchain, ensuring transparency and minimizing disputes.

Regulatory and Legal Considerations

The integration of blockchain technology into the auto insurance claims process presents a fascinating array of opportunities, but also necessitates careful consideration of the existing regulatory landscape and potential legal challenges. Navigating this complex terrain requires a proactive approach, ensuring compliance with existing laws and anticipating future regulatory developments. Failure to do so could significantly hinder adoption and even expose insurers to legal risks.The current regulatory environment for blockchain in insurance is still evolving, characterized by a patchwork of national and international laws and regulations.

This lack of standardized frameworks creates both opportunities and challenges. While some jurisdictions are actively exploring regulatory sandboxes to encourage innovation, others remain cautious, creating uncertainty for insurers looking to implement blockchain solutions. This ambiguity underscores the need for a comprehensive understanding of the relevant legal frameworks before deploying blockchain-based systems.

Data Privacy and Security Concerns

Implementing blockchain technology in auto insurance raises significant concerns regarding data privacy and security. Personal information, such as driver details, accident reports, and claims data, is highly sensitive and subject to strict data protection laws like GDPR in Europe and CCPA in California. Blockchain’s inherent transparency, while beneficial in other ways, presents a challenge in this context. Careful consideration must be given to data anonymization techniques and access control mechanisms to ensure compliance with these regulations and maintain the confidentiality of sensitive information.

For example, zero-knowledge proofs could be utilized to verify information without revealing the underlying data. The potential for data breaches and the subsequent liability for insurers necessitates robust security protocols and ongoing monitoring.

Compliance with Regulations and Data Protection Laws

Compliance with relevant regulations and data protection laws is paramount for insurers adopting blockchain solutions. This includes adhering to data privacy regulations, ensuring data security, and meeting requirements for data transparency and accountability. Insurers must conduct thorough due diligence to understand the specific legal requirements applicable to their jurisdiction and ensure their blockchain systems are designed and operated in accordance with these laws.

This may involve implementing robust data governance frameworks, conducting regular audits, and appointing a data protection officer. Failure to comply can lead to significant fines and reputational damage. For instance, a failure to anonymize personally identifiable information could result in non-compliance with GDPR, leading to substantial penalties.

Legal Frameworks Supporting or Hindering Blockchain Adoption

Legal frameworks can either significantly support or actively hinder the adoption of blockchain in auto insurance. Regulatory sandboxes, for example, provide a controlled environment for insurers to experiment with blockchain technology and gain valuable experience before full-scale implementation. Conversely, overly restrictive regulations, lack of clarity on data ownership and liability, or insufficient guidance on smart contract enforceability can create significant barriers to adoption.

Jurisdictions with clear legal frameworks that address data privacy, security, and smart contract legality are more likely to attract innovation and investment in blockchain-based insurance solutions. Conversely, uncertainty around legal liability for smart contract malfunctions could deter insurers from adopting the technology. The ongoing development of legal frameworks specifically addressing blockchain technology in insurance is crucial for fostering responsible innovation and promoting widespread adoption.

Conclusive Thoughts

So, there you have it: Blockchain technology has the potential to seriously disrupt the auto insurance claims game. By leveraging its inherent security, transparency, and automation capabilities, we can create a faster, more efficient, and trustworthy system. While challenges remain, the potential benefits – from reduced fraud to streamlined processing – are undeniable. It’s a bold new direction, and it’s definitely one worth watching.