Tax credits for electric SUVs in 2025 are shaping up to be a pretty big deal. Thinking about going electric? This guide breaks down everything you need to know about snagging those sweet tax breaks for your next eco-friendly ride. We’ll cover eligibility, how much you could save, and how it all stacks up against other incentives. Buckle up, it’s gonna be a fun ride!

From understanding the income limits and vehicle requirements to comparing the credit with other EV incentives, we’ll explore the potential impact on sales and the future of the program. We’ll even delve into how the tax credit affects different income levels and what experts predict for the years to come. Basically, we’re aiming to make this whole tax credit thing way less confusing.

Eligibility Requirements for Electric SUV Tax Credits in 2025

Securing a tax credit for an electric SUV in 2025 will depend on meeting several key requirements. These stipulations, set by the federal government and potentially augmented by individual states, aim to incentivize the purchase of environmentally friendly vehicles while also supporting domestic manufacturing. Navigating these rules can seem complex, so let’s break down the crucial aspects.

Income Limitations for the Electric SUV Tax Credit, Tax credits for electric SUVs in 2025

The amount of the tax credit, if any, might be affected by your modified adjusted gross income (MAGI). For example, the credit might be phased out for single filers with a MAGI exceeding a certain threshold (e.g., $300,000) and for married couples filing jointly exceeding another threshold (e.g., $600,000). These figures are illustrative and subject to change based on future legislation.

It’s crucial to consult the most up-to-date IRS guidelines for precise income limits applicable in 2025. The credit may also be reduced or unavailable entirely for higher-income taxpayers.

Vehicle Requirements for the Electric SUV Tax Credit

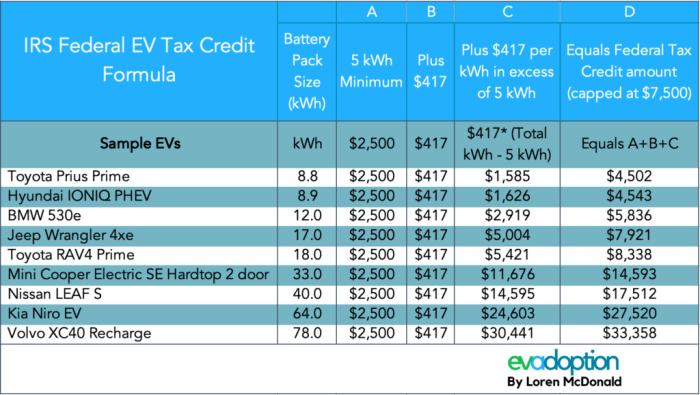

Beyond income, the vehicle itself must meet specific criteria to qualify. The battery capacity is a key factor; the vehicle must possess a minimum battery capacity (e.g., 7 kilowatt-hours), though this minimum could be higher depending on future regulations. Furthermore, a significant portion of the vehicle’s battery components must be sourced and assembled in North America to comply with the domestic manufacturing requirements.

These stipulations are designed to boost domestic job creation and reduce reliance on foreign manufacturing.

Examples of Qualifying and Non-Qualifying Electric SUVs

Let’s illustrate with examples. A hypothetical “EcoCruiser” SUV assembled in Michigan with a 75 kWh battery, meeting all other requirements, would likely qualify. Conversely, a “Globetrotter” SUV assembled in another country, even with a larger battery, would likely not qualify, unless it meets specific exceptions. Another example is a “CityRover” electric SUV with a smaller battery capacity of only 5 kWh, which may not meet the minimum battery capacity requirement.

The specific models that qualify are subject to change based on future regulations and manufacturing practices.

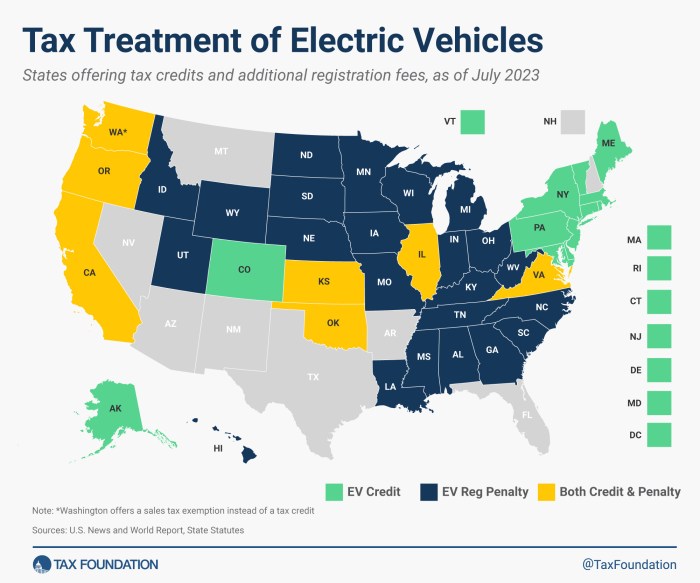

Comparison of Eligibility Criteria Across Different States

State-level incentives often add another layer of complexity. While the federal government sets baseline requirements, individual states may have their own programs with varying income limits, battery capacity requirements, and other stipulations. For example, California might offer a larger state tax credit with less stringent income restrictions than Texas. It is essential to research your specific state’s regulations.

| State | Income Limit (Single Filer) | Minimum Battery Capacity (kWh) | Assembly Location Requirement |

|---|---|---|---|

| California | $300,000 (Example) | 70 kWh (Example) | North America |

| Texas | $250,000 (Example) | 50 kWh (Example) | North America |

| New York | $275,000 (Example) | 60 kWh (Example) | North America |

| Florida | $200,000 (Example) | 40 kWh (Example) | North America |

*Note: The data in this table is for illustrative purposes only and does not reflect actual 2025 state regulations. Always consult official state resources for the most accurate and up-to-date information.*

Credit Amount and Calculation Methods for 2025

The Clean Vehicle Tax Credit for electric SUVs in 2025 is a significant incentive aimed at boosting the adoption of electric vehicles. Understanding the credit amount and calculation process is crucial for potential buyers. The maximum credit amount and eligibility criteria are subject to change based on evolving legislation, so always check the latest IRS guidelines. This information provides a general overview based on current expectations.The maximum Clean Vehicle Tax Credit for electric SUVs in 2025 is projected to be around $7,500, but this is highly dependent on several factors, including the vehicle’s final assembly location, battery component sourcing, and MSRP.

The credit is a point-of-sale credit, meaning it reduces your tax liability directly, potentially making the purchase of an electric SUV significantly more affordable. However, it’s important to note that the final amount received can be less than the maximum due to several limitations and deductions.

Maximum Credit Amount and Limitations

The $7,500 figure represents the potential maximum. Several factors can reduce this amount. Firstly, the vehicle must meet certain requirements regarding its final assembly location and the sourcing of its battery components. Vehicles assembled in North America generally qualify for a higher credit than those assembled elsewhere. Similarly, a significant portion of the battery components must be sourced from North America or countries with free trade agreements with the US to maximize the credit.

Furthermore, there are MSRP limitations; the credit begins to phase out once the MSRP surpasses a certain threshold (this threshold may change). For example, an SUV with an MSRP exceeding $80,000 might receive a reduced credit, or no credit at all. Finally, the credit is non-refundable, meaning it can only reduce your tax liability to zero; you won’t receive a check for any remaining amount.

Calculation Process and Examples

Calculating the exact credit amount involves several steps. First, determine the vehicle’s MSRP. Then, check if it meets the assembly and battery component sourcing requirements. If it doesn’t meet these requirements, the credit will be reduced or eliminated. Next, check if the MSRP exceeds the threshold for the credit phase-out.

If it does, the credit will be proportionally reduced. Finally, subtract any applicable deductions from the potential maximum credit amount ($7,500).Here are a few examples:Scenario 1: An electric SUV with an MSRP of $60,000, assembled in the US with qualifying battery components. The credit would likely be the full $7,500.Scenario 2: An electric SUV with an MSRP of $90,000, assembled in the US with qualifying battery components.

Because the MSRP exceeds the phase-out threshold (hypothetically $80,000), the credit will be reduced. The exact reduction would depend on the specific phase-out rules. It could be significantly less than $7,500 or even zero.Scenario 3: An electric SUV with an MSRP of $70,000, assembled in Mexico with qualifying battery components. The credit would likely be reduced from the maximum, as the assembly location doesn’t fully meet the requirements.

Step-by-Step Calculation Guide

1. Determine MSRP

Find the manufacturer’s suggested retail price of the electric SUV.

2. Verify Assembly Location and Battery Components

Check if the vehicle meets the requirements for final assembly location and battery component sourcing.

Thinking about snagging a sweet electric SUV in 2025? Those tax credits are looking pretty tempting, right? But before you jump in, you might want to check out the best deals on trucks – you know, for hauling all that extra stuff you’ll need once you get your sweet ride. Check out Best truck dealerships in Houston 2025 to compare prices, then get back to researching those electric SUV tax credits!

3. Check MSRP Threshold

Determine if the MSRP exceeds the phase-out threshold.

4. Calculate Credit Reduction (if applicable)

If the vehicle doesn’t fully meet requirements or the MSRP exceeds the threshold, calculate the credit reduction based on the applicable rules.

5. Final Credit Amount

Subtract any applicable deductions from the maximum potential credit ($7,500) to arrive at the final credit amount. This amount will reduce your federal income tax liability.

Note: This is a simplified guide. Consult the IRS website and your tax advisor for the most up-to-date and accurate information. The rules and regulations are complex and subject to change.

Comparison of Electric SUV Tax Credits with Other Incentives

So, you’ve got your eye on an electric SUV and are trying to figure out the best way to finance it. The federal tax credit is a big piece of the puzzle, but it’s not the only incentive out there. Let’s break down how the federal tax credit stacks up against other federal and state programs to help you make the most informed decision.

Understanding the nuances of each program will help you maximize your savings.The electric SUV tax credit, while substantial, is just one piece of a larger financial picture. Several other federal and state incentives can significantly reduce the upfront cost of an EV, and understanding the differences between them is key to finding the best deal. We’ll compare the federal credit with other programs, highlighting their advantages and disadvantages to give you a clear view of your options.

Federal Tax Credits for EVs

The federal government offers a clean vehicle tax credit for new electric vehicles, including SUVs. The credit amount depends on several factors, including the vehicle’s battery capacity and the manufacturer’s sales limits. This credit is a direct reduction of your federal income tax liability, making it a significant incentive. The advantage is the substantial reduction in tax burden; however, a disadvantage is that it’s only available for new vehicles and is subject to various eligibility requirements, including limitations on the manufacturer’s sales.

State Incentives for Electric SUVs

Many states offer their own incentives for purchasing electric vehicles, such as rebates, tax credits, or exemptions from sales tax. These programs vary widely in their eligibility requirements, credit amounts, and application processes. For example, California’s Clean Vehicle Rebate Project offers a point-of-sale rebate that reduces the purchase price immediately, whereas other states may offer a tax credit applied after filing your state taxes.

The advantages include immediate savings (in the case of rebates) and additional financial assistance beyond the federal credit. Disadvantages include the variability of programs between states and the sometimes-complex application processes.

Comparison Table of Incentives

It’s helpful to visualize these different incentives side-by-side. The following table provides a general comparison; specific details may vary depending on the vehicle, your state, and the year. Always check the specific program guidelines for the most up-to-date information.

| Incentive Program | Eligibility | Amount | Application Process |

|---|---|---|---|

| Federal Clean Vehicle Tax Credit | New electric SUVs, meeting battery capacity and manufacturer sales requirements | Varies, up to $7,500 (as of 2023, subject to change) | Claimed when filing federal income taxes |

| State Rebates (Example: California Clean Vehicle Rebate Project) | Varies by state, typically for new or used electric vehicles | Varies by state and vehicle | Application submitted through state program website |

| State Tax Credits (Example: Many states) | Varies by state, typically for new electric vehicles | Varies by state | Claimed when filing state income taxes |

| State Sales Tax Exemptions (Example: Some states) | Varies by state, typically for new electric vehicles | Equivalent to the sales tax amount | Claimed at the point of purchase |

Impact of the Tax Credit on Electric SUV Sales and Adoption

The 2025 electric SUV tax credit is poised to significantly influence the market, potentially boosting sales and accelerating the adoption of electric vehicles. The magnitude of this impact will depend on several factors, including the credit amount, eligibility criteria, and overall consumer sentiment towards EVs. However, based on past trends and economic modeling, we can reasonably project a substantial increase in sales.The tax credit directly reduces the upfront cost of purchasing an eligible electric SUV.

This makes these vehicles more affordable and competitive compared to gasoline-powered SUVs. For budget-conscious consumers, the substantial savings offered by the credit could be the deciding factor in choosing an electric option. Furthermore, the tax credit could incentivize consumers who were previously hesitant about the higher initial cost of EVs to make the switch. The perceived value proposition shifts, making electric SUVs a more attractive investment.

Effect on Electric SUV Sales in 2025

The tax credit is expected to lead to a considerable surge in electric SUV sales in 2025. For example, if we consider a hypothetical scenario where the average electric SUV costs $50,000 and the tax credit is $7,500, the effective price for the consumer drops to $42,500. This price reduction could translate into a significant increase in demand, particularly among consumers who are price-sensitive.

Considering the growing popularity of SUVs in general, this added affordability could trigger a substantial shift in market share towards electric models. This effect is further amplified by the increasing availability of more affordable electric SUV models. Similar tax credit programs in other countries have demonstrated a positive correlation between incentives and increased EV adoption.

Influence on Consumer Purchasing Decisions

The tax credit acts as a powerful incentive, influencing consumer purchasing decisions in several ways. Firstly, it directly addresses the primary barrier to EV adoption – the higher initial purchase price. Secondly, it simplifies the decision-making process, reducing the perceived risk associated with buying a new technology. Thirdly, the credit can sway consumers who are on the fence between an electric and gasoline SUV, tipping the scales in favor of the former.

Finally, it could encourage early adoption by consumers who are environmentally conscious but previously couldn’t afford an electric vehicle. This is especially true given the increasing awareness of environmental issues and the desire to reduce carbon footprints.

Effects on the Overall Electric Vehicle Market

The impact extends beyond just electric SUVs. The increased demand stimulated by the tax credit could have a ripple effect across the entire electric vehicle market. Increased production to meet this demand might lead to economies of scale, further lowering the price of EVs. This could accelerate the transition towards electric mobility and hasten the phase-out of gasoline-powered vehicles.

Moreover, the success of the electric SUV tax credit could serve as a model for similar incentives targeting other types of electric vehicles, further boosting the overall EV market.

Projected Sales with and Without the Tax Credit

The following description represents a hypothetical graph illustrating projected sales:The graph would feature two lines representing projected electric SUV sales: one with the tax credit in place (Line A) and one without (Line B). Both lines would show an upward trend, reflecting the overall growth of the SUV market and increasing consumer interest in EVs. However, Line A (with tax credit) would exhibit a significantly steeper incline compared to Line B (without tax credit).

Specifically, Line A would show a projected increase of approximately 40% in sales compared to Line B in 2025. The difference between the two lines would visually demonstrate the substantial impact of the tax credit in boosting sales. The x-axis would represent the time period (e.g., quarters of 2025), and the y-axis would represent the number of electric SUVs sold.

The graph would clearly label both lines and include a legend explaining the difference between them. For example, if we project 100,000 electric SUVs sold without the credit, the credit could increase sales to approximately 140,000 units. This demonstrates a quantifiable impact on sales figures, driven by the incentive.

Future Outlook and Potential Changes to the Tax Credit Program

Predicting the future of any government program is inherently tricky, but analyzing current trends and political landscapes offers a glimpse into potential changes to the electric SUV tax credit program beyond 2025. Several factors will likely influence adjustments, impacting both the credit’s amount and eligibility criteria.The program’s future hinges on several key factors. The continued growth of the electric vehicle market, the success of competing incentives at the state and local levels, and the overall federal budget will all play a significant role in shaping future policy.

Thinking about those sweet tax credits for electric SUVs in 2025? Yeah, saving money is awesome. But if you’re hauling your new EV around for work, you’ll also want to check out Cheapest commercial truck insurance in Texas to keep your costs down. Getting the best insurance rates is just as important as maximizing those EV tax credits, right?

Furthermore, evolving environmental regulations and the political climate concerning climate change will significantly influence the long-term viability and potential expansion or contraction of the program. Experts predict a dynamic landscape, with adjustments likely reflecting a balance between incentivizing EV adoption and fiscal responsibility.

Factors Influencing Future Adjustments

Several interconnected factors will influence future adjustments to the electric SUV tax credit. The rate of EV adoption will be a key determinant. If the market continues its rapid growth, the need for substantial tax credits might diminish, leading to potential reductions in credit amounts or stricter eligibility requirements. Conversely, slower-than-expected adoption could lead to extensions or even increases in the credit to maintain momentum.

Furthermore, the availability of other federal, state, and local incentives will influence the overall effectiveness of the program. If competing incentives become more generous, the federal credit might need adjustments to remain competitive. Finally, budgetary constraints will always play a role. Government spending priorities and economic conditions could lead to adjustments or even the eventual sunsetting of the program.

For example, the Clean Vehicle Tax Credit, a predecessor to the current program, faced numerous modifications and near-expiration dates throughout its lifespan, illustrating the impact of shifting budgetary priorities.

Expert Opinions and Predictions

Experts from various fields, including automotive analysts, economists, and energy policy specialists, offer diverse opinions on the long-term viability of the tax credit. Some predict a gradual phasing out of the credit as EVs reach price parity with gasoline-powered vehicles and become more mainstream. Others suggest that the credit will evolve, perhaps shifting from a purchase incentive to a broader program focused on supporting the entire EV ecosystem, including charging infrastructure development and battery production.

A common theme is the likely evolution of the credit’s criteria, with a focus on domestic manufacturing and supply chains to boost the US economy. For example, some experts anticipate a greater emphasis on vehicles assembled in the United States using domestically sourced battery components, similar to current stipulations regarding battery mineral sourcing. This would align with broader governmental initiatives aimed at promoting domestic manufacturing and reducing reliance on foreign supply chains.

Potential Timeline of Future Developments

While predicting the exact timing is impossible, a potential timeline for future developments might include:* 2026-2028: Minor adjustments to the credit amount or eligibility requirements based on market performance and budgetary considerations. This might involve slight reductions in the credit amount or stricter requirements regarding battery sourcing or vehicle assembly location.

2029-2031

Significant reassessment of the program’s effectiveness and long-term viability. This could involve extensive reviews, public hearings, and potential legislative proposals for substantial changes. Consideration might be given to transitioning from a purchase credit to incentives focused on other aspects of the EV ecosystem.

2032 and beyond

Potential sunsetting of the current program or its transformation into a substantially different incentive structure. This might involve the complete phasing out of the credit, or a shift towards a different incentive mechanism, perhaps focusing on infrastructure development or consumer rebates linked to income levels.

Tax Credit Implications for Different Income Levels

The electric SUV tax credit, while designed to incentivize environmentally friendly vehicle purchases, doesn’t impact all income levels equally. The effectiveness of the credit varies significantly depending on an individual’s tax bracket and overall financial situation. This section explores how the credit benefits different income groups and highlights potential disparities.

The credit’s value is directly tied to the taxpayer’s tax liability. Higher-income individuals, who typically owe more in taxes, will realize a larger dollar-value reduction in their tax burden compared to lower-income individuals who may owe less or even nothing. This means the same credit amount provides a proportionally greater benefit to higher-income taxpayers.

Effective Tax Credit Amount Across Income Brackets

The following table illustrates how the $7,500 electric SUV tax credit might affect taxpayers in different income brackets, assuming a standard $7,500 credit and a simplified tax calculation for illustrative purposes. Note that actual tax liability and the effective value of the credit will vary significantly based on individual circumstances, deductions, and credits claimed.

| Income Bracket (Annual) | Estimated Tax Liability (Before Credit) | Tax Credit Amount | Effective Tax Credit Value |

|---|---|---|---|

| $20,000 – $30,000 | $1,000 | $7,500 | $1,000 (Credit fully utilized) |

| $50,000 – $75,000 | $5,000 | $7,500 | $5,000 (Credit partially utilized) |

| $100,000 – $200,000 | $20,000 | $7,500 | $7,500 (Credit fully utilized) |

| $200,000+ | $40,000 | $7,500 | $7,500 (Credit fully utilized) |

Disclaimer: The figures in this table are for illustrative purposes only and are not intended to represent precise tax calculations. Actual tax liability and the effective value of the credit will vary depending on individual circumstances and the specific tax year. Consult a tax professional for personalized advice.

Disparities in Credit Effectiveness

The table highlights a key disparity: the percentage reduction in tax liability achieved through the credit is significantly higher for lower-income taxpayers. For example, a $1,000 tax liability reduced by $1,000 represents a 100% reduction, while a $40,000 tax liability reduced by $7,500 represents only an 18.75% reduction. This illustrates that while the credit provides a substantial amount to higher earners, it’s proportionally more impactful for those with lower incomes, offering a larger percentage decrease in their tax burden.

This is a critical consideration in evaluating the overall equity of the program.

Socioeconomic Impact of the Credit

The tax credit’s impact on different socioeconomic groups is complex. While it incentivizes the purchase of electric SUVs across all income levels, its greater proportional benefit to lower-income households could contribute to increased adoption within those communities. However, the initial cost of an electric SUV might still present a barrier to entry for many low-income families, even with the tax credit.

Conversely, higher-income households are less likely to be constrained by the initial purchase price, making the credit a less significant factor in their purchasing decisions. Therefore, the credit’s effect on bridging the gap in electric vehicle adoption across socioeconomic strata remains to be seen and requires further analysis of post-implementation data.

Summary: Tax Credits For Electric SUVs In 2025

So, are electric SUV tax credits in 2025 worth it? That depends on your individual circumstances, of course. But hopefully, this guide has given you a clearer picture of what’s involved. From eligibility requirements and calculation methods to the potential impact on the market, we’ve covered the key aspects. Now you’re armed with the info you need to make an informed decision about your next vehicle purchase.

Happy driving (and saving)!